11 Money Mistakes We Make in Our Youth That We Come to Regret Later

Here’s a revised list of 11 common money mistakes made in youth that often lead to regret later in life:

11 Money Mistakes We Make in Our Youth That We Come to Regret Later

**1. Neglecting a Budget:

•Description: Many young people fail to create and follow a budget, leading to uncontrolled spending.

•Regret: This can result in accumulating debt and difficulty managing finances effectively.

**2. Accumulating High-Interest Credit Card Debt:

•Description: Using credit cards for non-essential purchases without paying off the balance can lead to high-interest debt.

•Regret: Over time, interest and fees can become a significant financial burden, affecting long-term financial stability.

**3. Lack of Savings and Emergency Fund:

•Description: Failing to set aside money for savings or emergencies is a common oversight.

•Regret: Without savings, it becomes challenging to handle unexpected expenses or financial setbacks.

**4. Delaying Investments:

•Description: Many young people miss out on investment opportunities due to prioritizing immediate gratification over long-term gains.

•Regret: Delaying investments means missing out on the benefits of compound interest and potential financial growth.

**5. Overlooking Student Loan Repayment:

•Description: Taking on student loan debt without a clear plan for repayment can be problematic.

•Regret: High student loan payments can strain finances and delay achieving other financial goals.

**6. Living Beyond Their Means:

•Description: Spending excessively on lifestyle choices or luxury items beyond their financial capacity.

•Regret: This often leads to financial instability and difficulty meeting financial obligations.

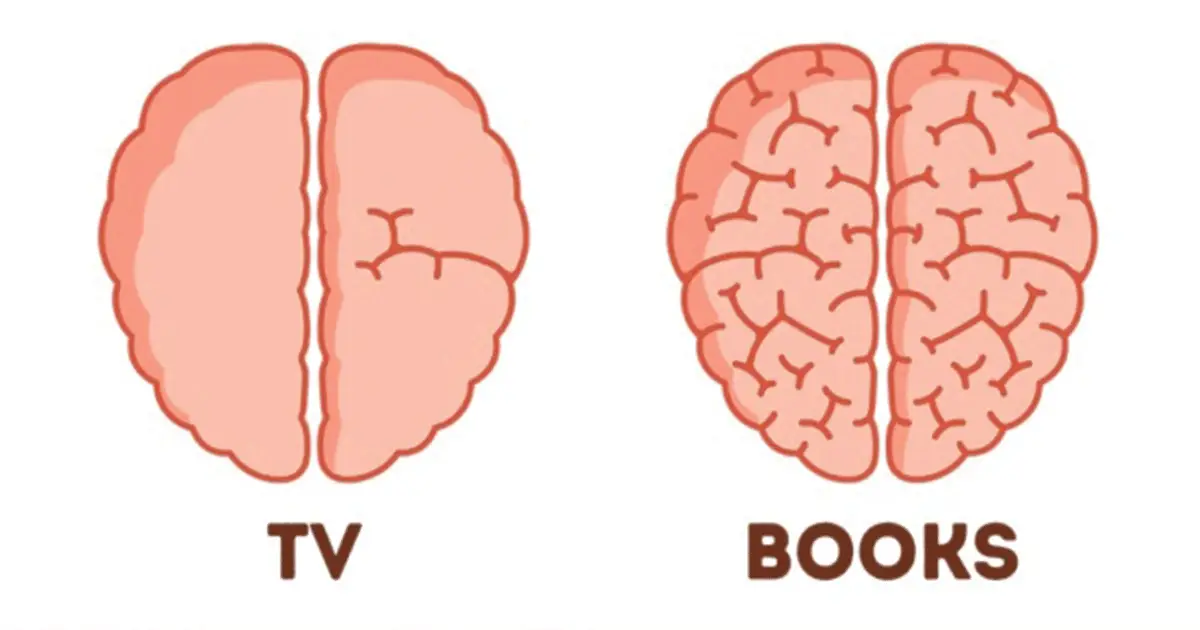

**7. Lack of Financial Education:

•Description: Not investing time in learning about personal finance, investing, and money management.

•Regret: Limited financial knowledge can lead to poor decisions and missed opportunities.

**8. Ignoring Retirement Savings:

•Description: Neglecting to contribute to retirement accounts or savings plans early on.

•Regret: Missing out on compound growth and having to catch up on retirement savings later in life.

**9. Making Impulsive Purchases:

•Description: Buying items impulsively without assessing their necessity or financial impact.

•Regret: Impulsive spending can lead to financial strain and regret over wasted money.

**10. Skipping Essential Insurance:

•Description: Forgoing necessary insurance coverage, such as health, auto, or renters insurance.

•Regret: Lack of insurance can lead to significant financial setbacks in case of accidents or emergencies.

**11. Failing to Set and Track Financial Goals:

•Description: Not setting clear financial goals or having a plan to achieve them.

•Regret: Without defined goals, it’s difficult to measure progress and stay motivated, which can hinder financial growth and achievement.

By addressing these common mistakes, young people can make more informed decisions and build a solid financial foundation for the future.